FREE PITCH DECK TEMPLATE

How to build a pitch deck that makes investors smile

This pitch deck template and example includes sample content plus simple, actionable recommendations that will help you optimize each slide in your pitch deck.

This pitch deck template and example includes sample content plus simple, actionable recommendations that will help you optimize each slide in your pitch deck.

A pitch deck is a 15-20 slide presentation you can use to share your startup idea and investment thesis. It should be clear, concise, and compelling. As a founder, you can use it to attract potential investors like angel investors, venture capitalists, and private equity firms. You can also use it to recruit co-founders, advisors, and early employees.

Done correctly, a pitch deck is an effective way to answer common investor questions like:

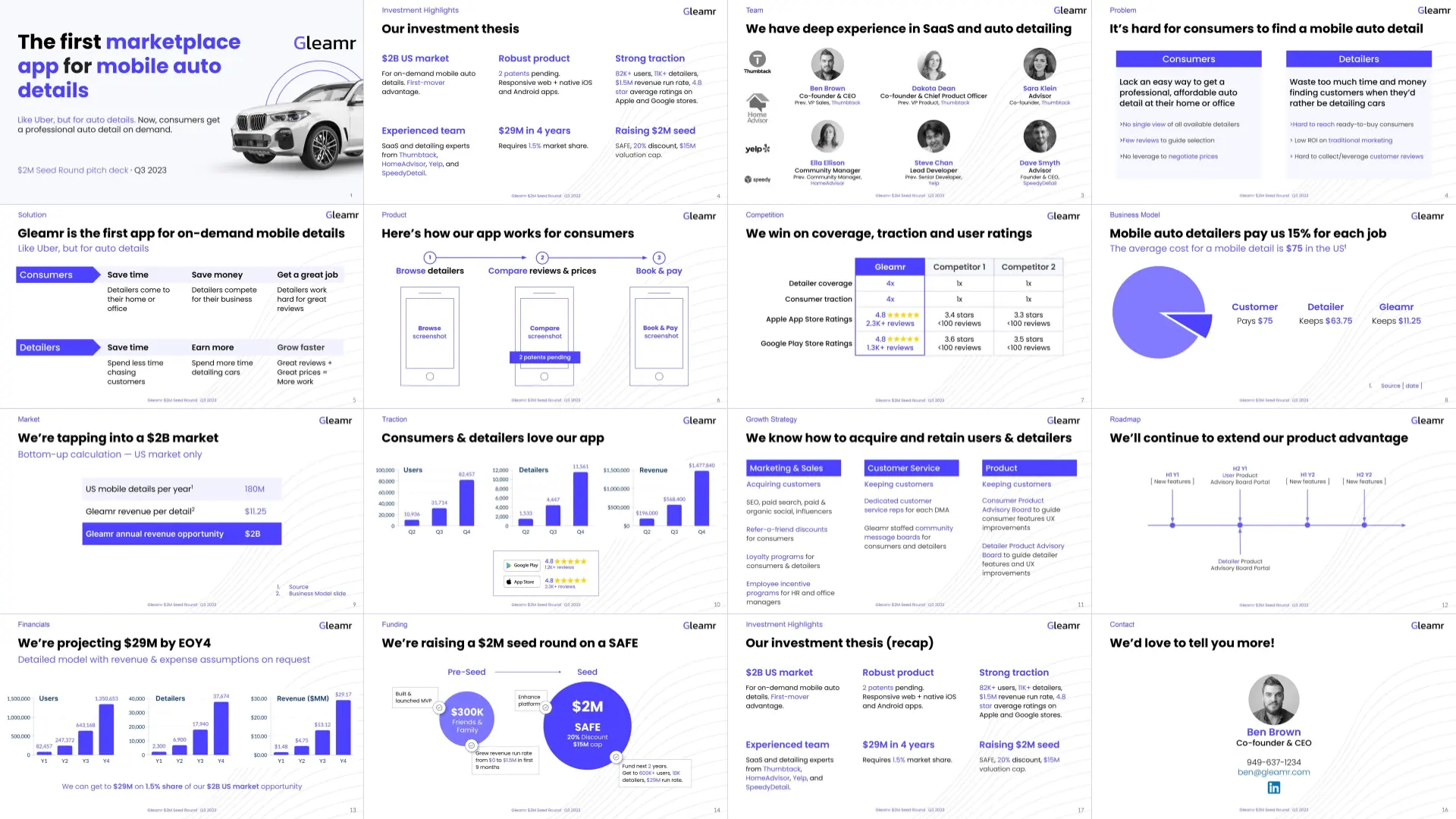

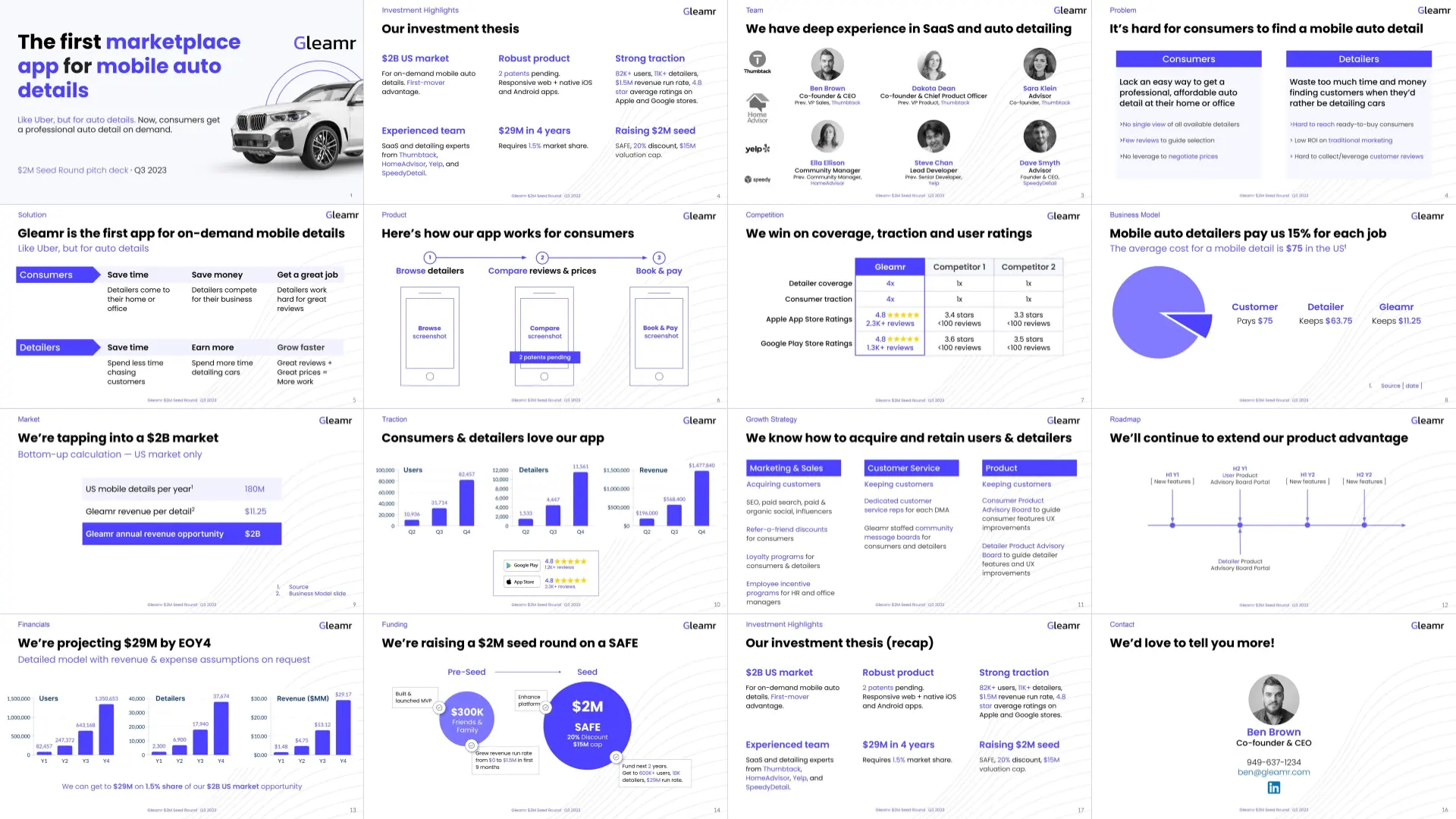

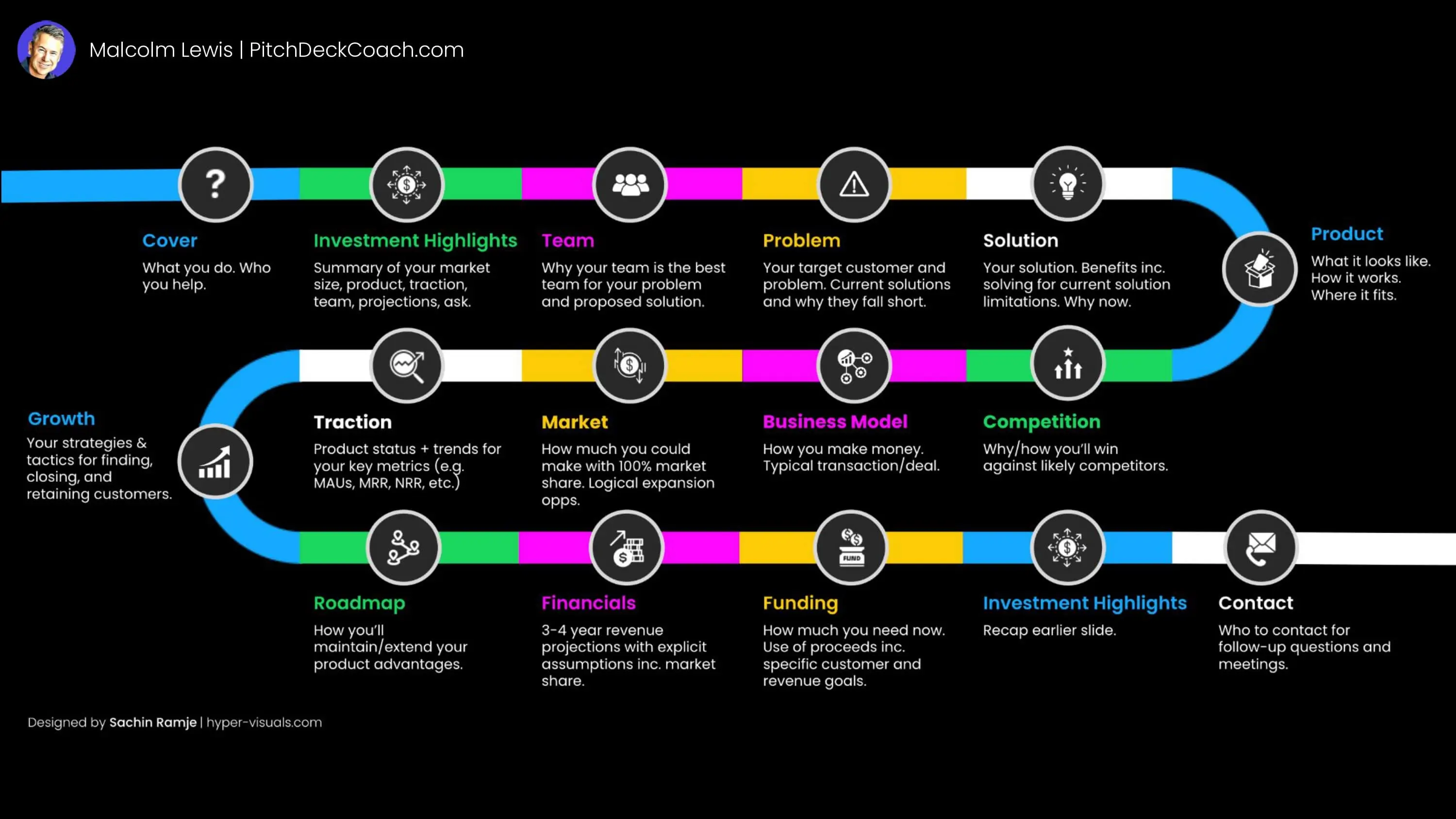

There's no such thing as a one-size-fits-all pitch deck template, but this flow is as good as any for most early-stage tech startups.

Your pitch deck needs to address every aspect of your business that you might include in a business plan. Here's what to include on each slide:

Announce your big idea—the one thing you do better than anyone else. You have 10 seconds to hook your audience. Cover slide example.

Summarize the highlights of your business and investment opportunity. Provide a teaser for what's to come. Investment Summary slide example.

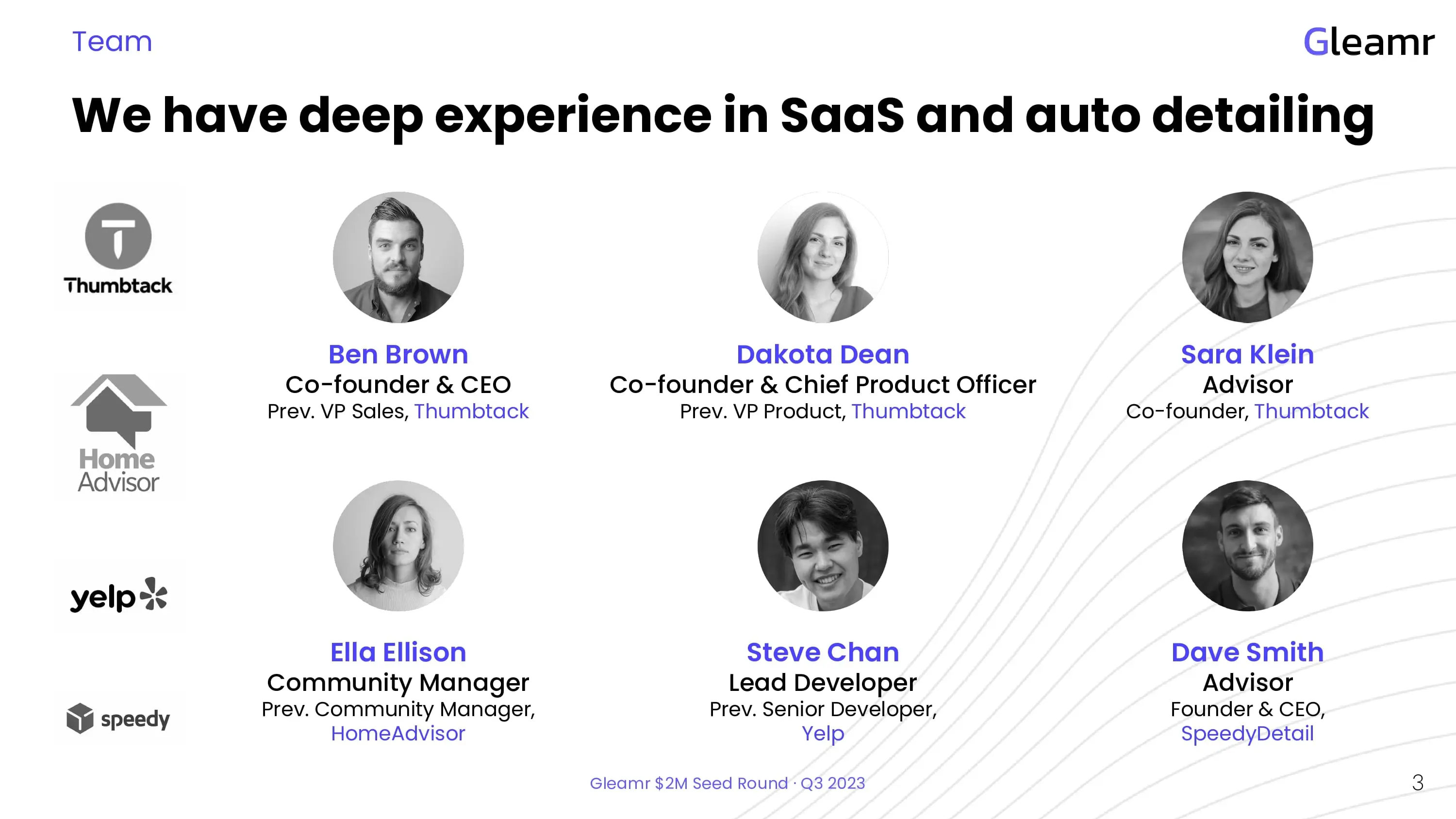

Introduce a team with the experience and expertise to transform your opportunity into a large, profitable business. Team slide example.

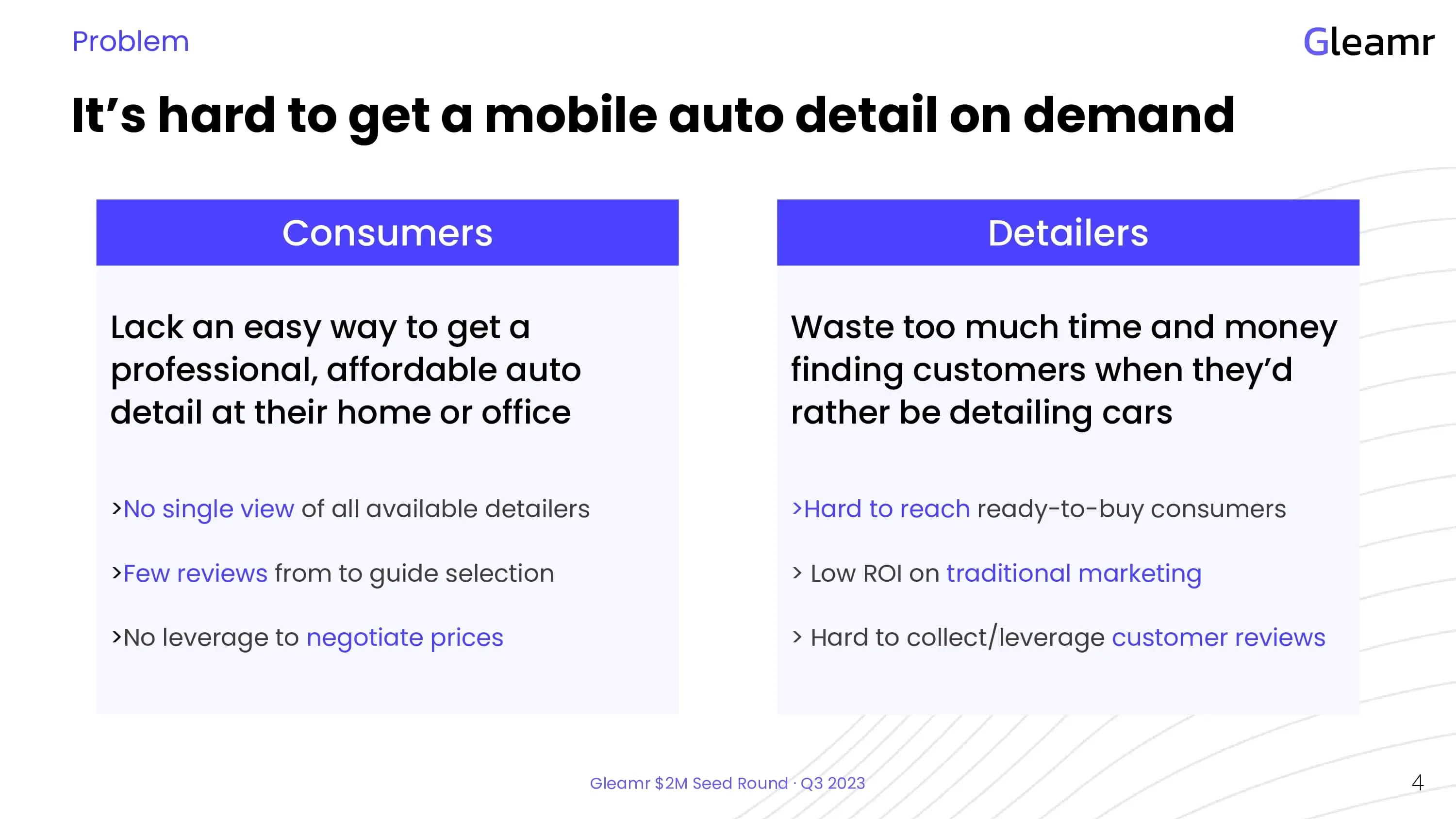

Describe the problem you solve. Identify your target customers (and users) and explain why they are frustrated with current solutions. Problem slide example.

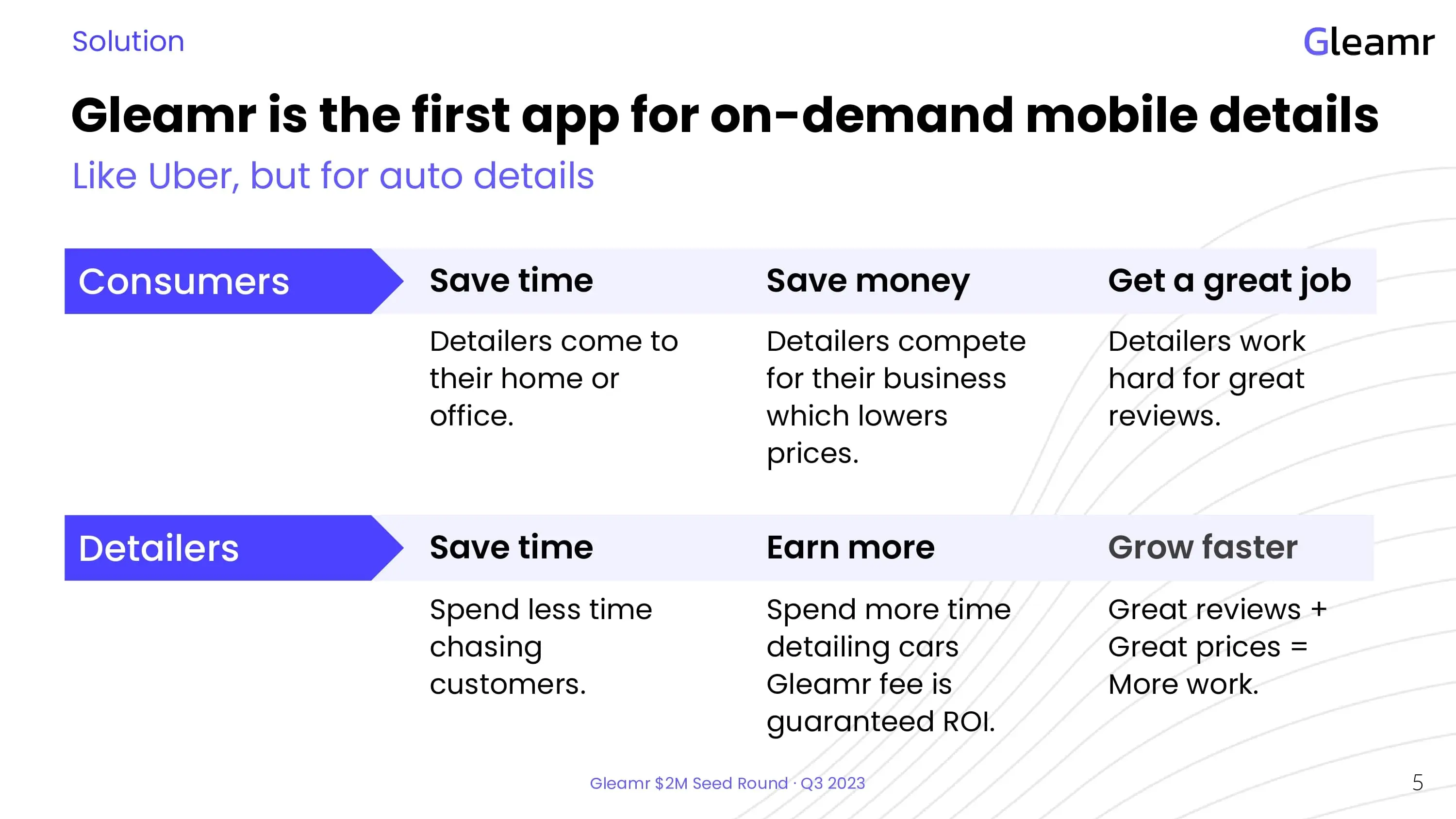

Explain how you provide a better solution and list the unique benefits for customers and users. Solution slide example.

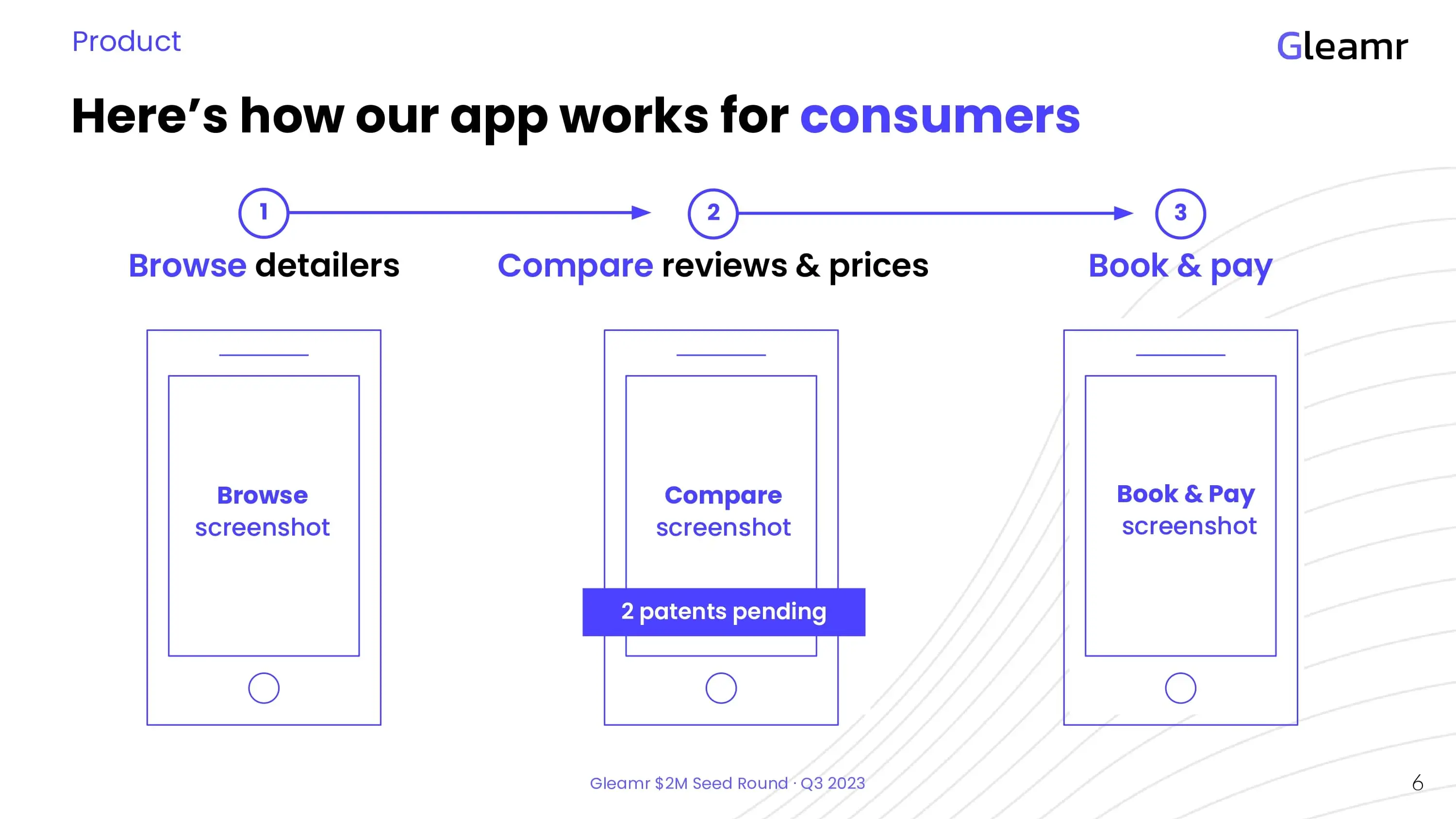

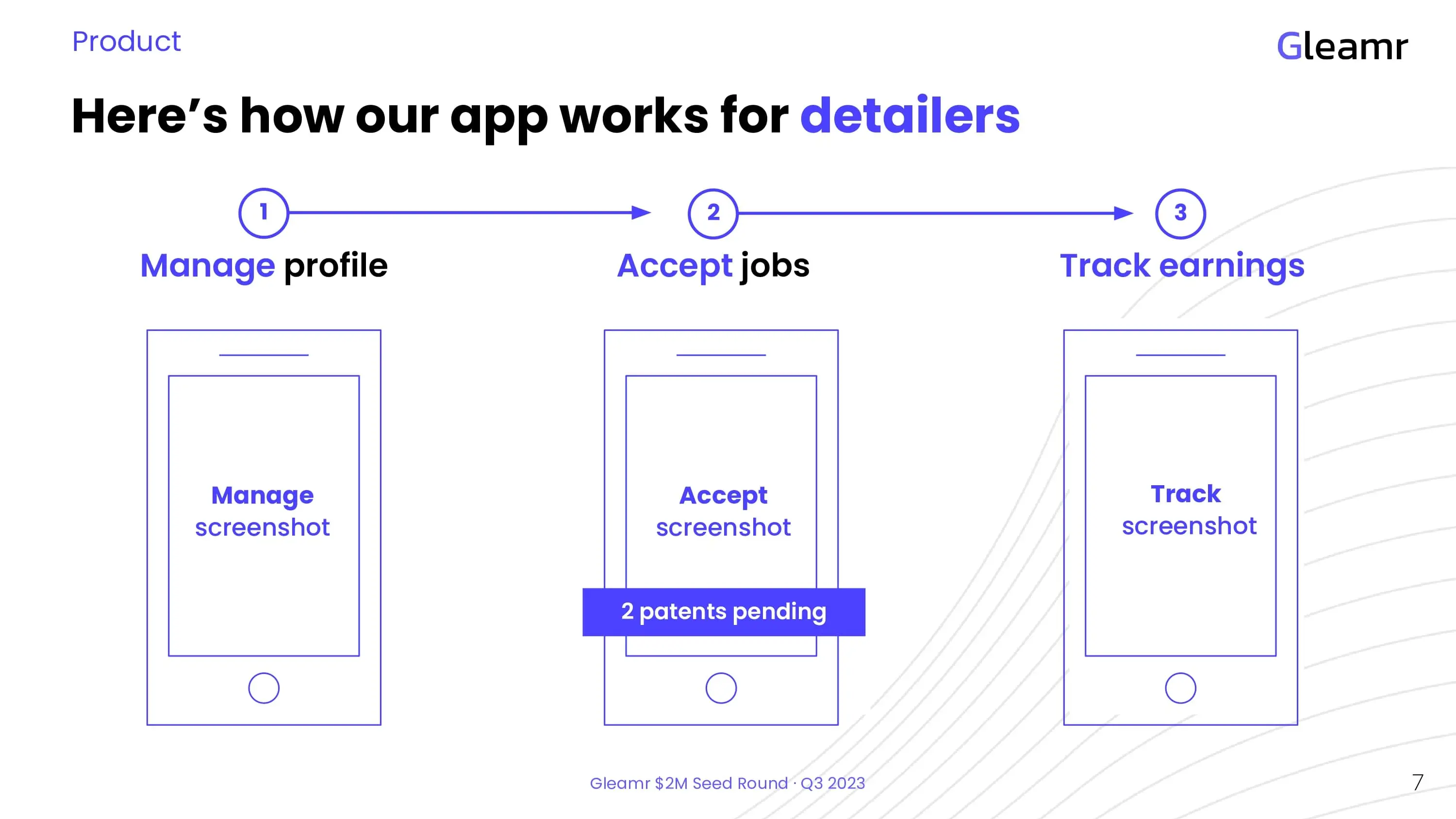

Show how your product works in three simple steps. Keep it visual. Product slide example.

List your competitors. Explain why your product is better than theirs in the eyes of your customers and users. Competition slide example.

Explain how you make money. Business Model slide example.

Show how much money you'll make when you dominate your target market. Market Opportunity slide example.

Prove that customers love your product and are willing to pay for it. Traction slide example.

Explain how you'll acquire and retain customers. Growth Strategy slide example.

Show how you'll keep your product competitive. Product Roadmap slide example.

Provide a simple model, with explicit assumptions, of how much money you can make in the next 3-5 years. Financials slide example.

Ask for the money you need and explain what you'll do with it. Funding slide example.

Restate the highlights of your business and investment opportunity as a closer. Investment Highlights Recap slide example.

Provide contact details for your primary investor contact. Usually the founder/CEO. Contact slide example

Optional. Include a few slides with positive press mentions, happy customer quotes, a summary of your technology stack, your detailed financial model, executive and advisor bios, etc.

I like to use standard slide titles as slide context labels with a descriptive subtitle in a larger font. Let your sub-title be the key takeaway for the slide. Add an image or chart with a few short bullets. Nobody wants to read long, boring slides that try to communicate too much. Embrace the KISS principle and think of each slide as a newspaper article. Your slide title is the headline, your sub-title expands on the headline, and your image and bullets provide the details. Your story builds slide by slide until you reach your final slide — the ask!

Now let's review what you should include on each slide of your pitch deck. We'll start with your cover slide.

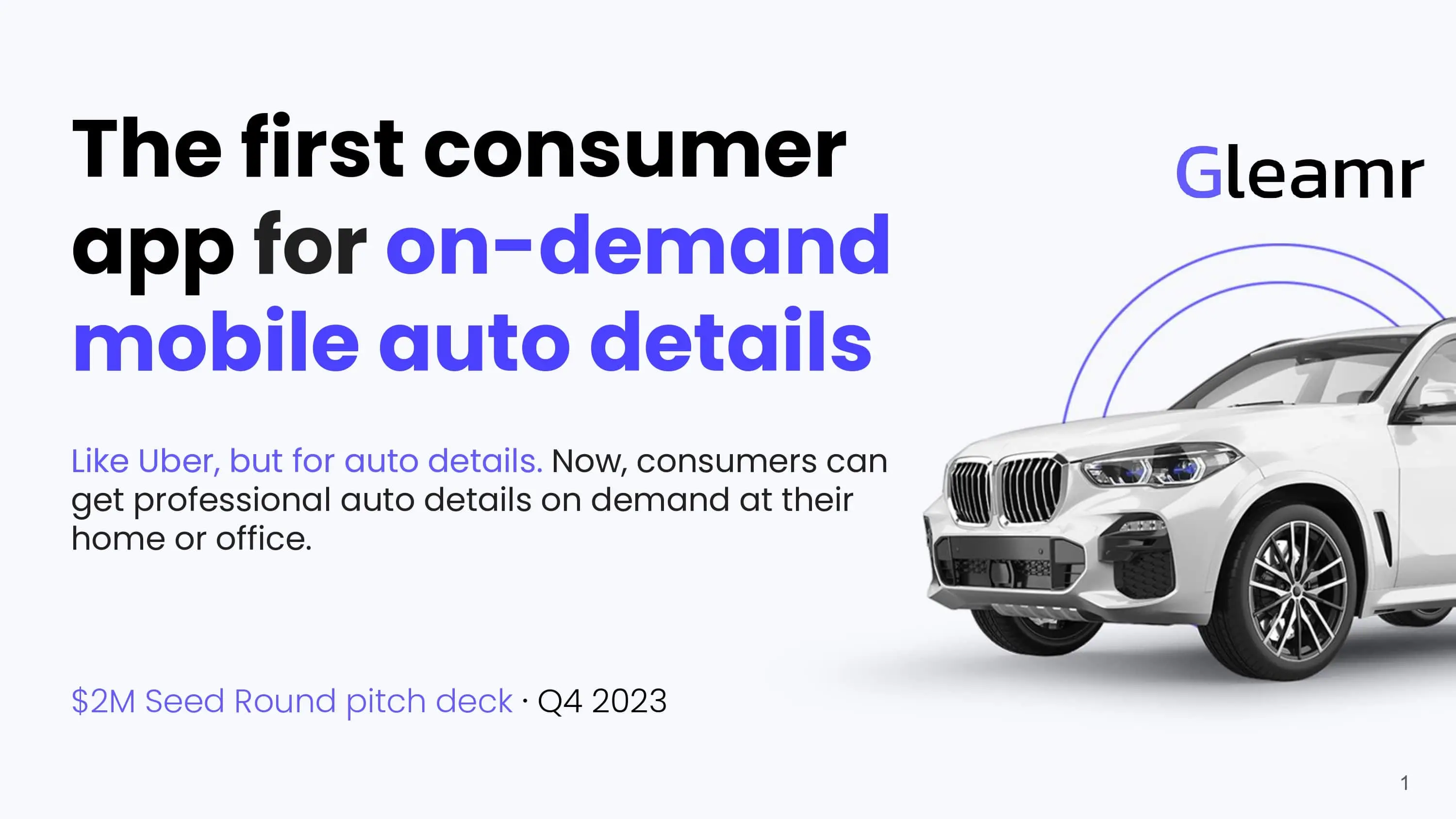

Your pitch deck's cover slide is crucial, like a website homepage. Don't just use a logo and a vague statement. Instead, present your main idea and grab your audience's attention within the first 10 seconds to keep them engaged for 20 minutes. Show investors why they need your product or service to pass the first test; otherwise, you might lose them.

Clearly state your product category and target customers, like: "Our store project management software helps luxury retail brands remodel stores on time and on budget."

Or, compare to a well-known category leader: "We're like Procore, but for luxury retail stores." This helps investors understand your business and sets you apart from competitors.

Add an image if it illustrates your product or supports your main idea without being distracting.

Begin by summarizing your business highlights to capture investors' attention. Don't make them wait to understand your investment thesis; present it upfront and emphasize growth potential while addressing market, product, team, and execution risks.

Take 30 seconds on this slide to assure your audience that you'll answer their questions soon. Some investors may ask questions early on, so use this slide to show that you'll address their concerns promptly.

If possible, include traction on this slide, as it excites investors and validates your product and market opportunity. Traction demonstrates that your minimum viable product (MVP) is effective and you've achieved some product-market fit (PMF). Investing in a startup scaling from initial PMF is less risky than investing in a pre-MVP startup still developing an idea.

Your Team slide is another critical slide that often gets insufficient attention. It speaks to execution risk. Investors want to see experience and expertise in as many of the following areas as possible.

Your team must include a business leader who owns and drives the company and product visions. And it must include a technology leader who owns and drives product delivery. Investors also like to see brand-name startups on a team member's resume. And they also like to see team members who have worked together before, ideally for another startup, especially if that startup was successful.

Include every member of your extended team on your team slide. Your extended team includes founders, key employees, advisors, and any existing investors. You only need to list current titles and current and former companies on the Team slide. You can provide detailed bios in your appendix.

Creating an advisory board is a simple way to add industry expertise to your "team." For example, being able to say, "We have the CMO of the largest real estate brokerage in the world on our advisory board," boosts your credibility if you're focusing on a real estate opportunity. Advisors can also help you refine your business and product vision and connect you to others who can do the same. You can also use advisors to add technology and startup experience and expertise to your team.

Explain the problem you solve. Or the unmet need you address. And who you're helping. Use simple terms that any investor can understand the overarching business issue and the underlying problem drivers. Identify the people who are dealing with this problem. These are your target customers and users. Define your ideal customer (verticals, geographies, revenue range, employee count range) and target personas (departments, roles, titles).

How painful is the problem you solve? Is it a must-solve problem or a nice-to-solve problem? Is it the number one problem for your customers and users? Or a minor irritation? How do your customers and users solve this problem today? Manually? Or with some older generation technology? What are the issues with these current solutions that create the opportunity for a new solution like yours?

Is your problem obvious? If not, what proof do you have that it exists?

Note that your Problem slide is the setup for your Solution and Competition slides. Match each limitation of existing solutions on your Problem slide to a benefit — with supporting features — on your Solution slide. Similarly, the feature-benefits listed on your Solution slide provide the basis for head-to-head comparisons with your competitors on your Competition slide.

In your Problem slide, you should have explained how your customers and users solved a painful problem before you came along. And you should have discussed their issues with those current solutions.

Now it's time to describe your solution as a new alternative. Again, use simple language. First, what is it? Provide some high-level context for your audience. Is it an app? A website? A device?

Next, what does it do? And what are the significant features and benefits for your customers and users? Again, derive each benefit from a feature that solves a problem you introduced in your Problem slide.

If current solutions are slow, expensive, and difficult to use, what is your solution? Faster? Less expensive? Easier to use? Once presented, your answers beg the follow-up questions: By how much? How much faster? How much cheaper? How much easier to use? Enough for your target customers and users to care? Enough to make them switch to your solution?

Think about a product or service that you recently switched to and ask yourself why you changed.

Features versus benefits versus value: Try to be consistent in your description of features versus user benefits and business value. Product features provide user benefits. User benefits deliver business value. For example:

Avoid listing product features in a vacuum. Always link product features to user benefits and business value.

In your Solution slide, you described the what and why of your product. What is it? What does it do? And why will your customers and users care enough to stop using current solutions and switch to yours? Now you need to make your product very tangible to investors by explaining how it works. This is where you transition from what and why to how.

Keep it simple and show how your product works in three easy steps. Show your product user experience for each customer and user identified in your Problem slide. You don't need to do a demo here. Screenshots or video are sufficient — and benefit from never crashing in front of investors. They also work great for investors who are skimming through your deck while standing in line at Starbucks. If you link to a demo video, make sure you generate captions for your video so people can watch it without the sound.

Your Product slide is also a great place to highlight any technology patents you might own or have in the works. If your patents prevent competitors from copying critical aspects of your solution, consider adding a dedicated Technology slide. Think about Overture's patent on pay-per-click advertising as an example of a strong patent that provided a significant competitive advantage. Briefly describe your patents and explain where they fit into your solution. For example, are the patents core to your product or peripheral? Remember also to mention your patents' filing status.

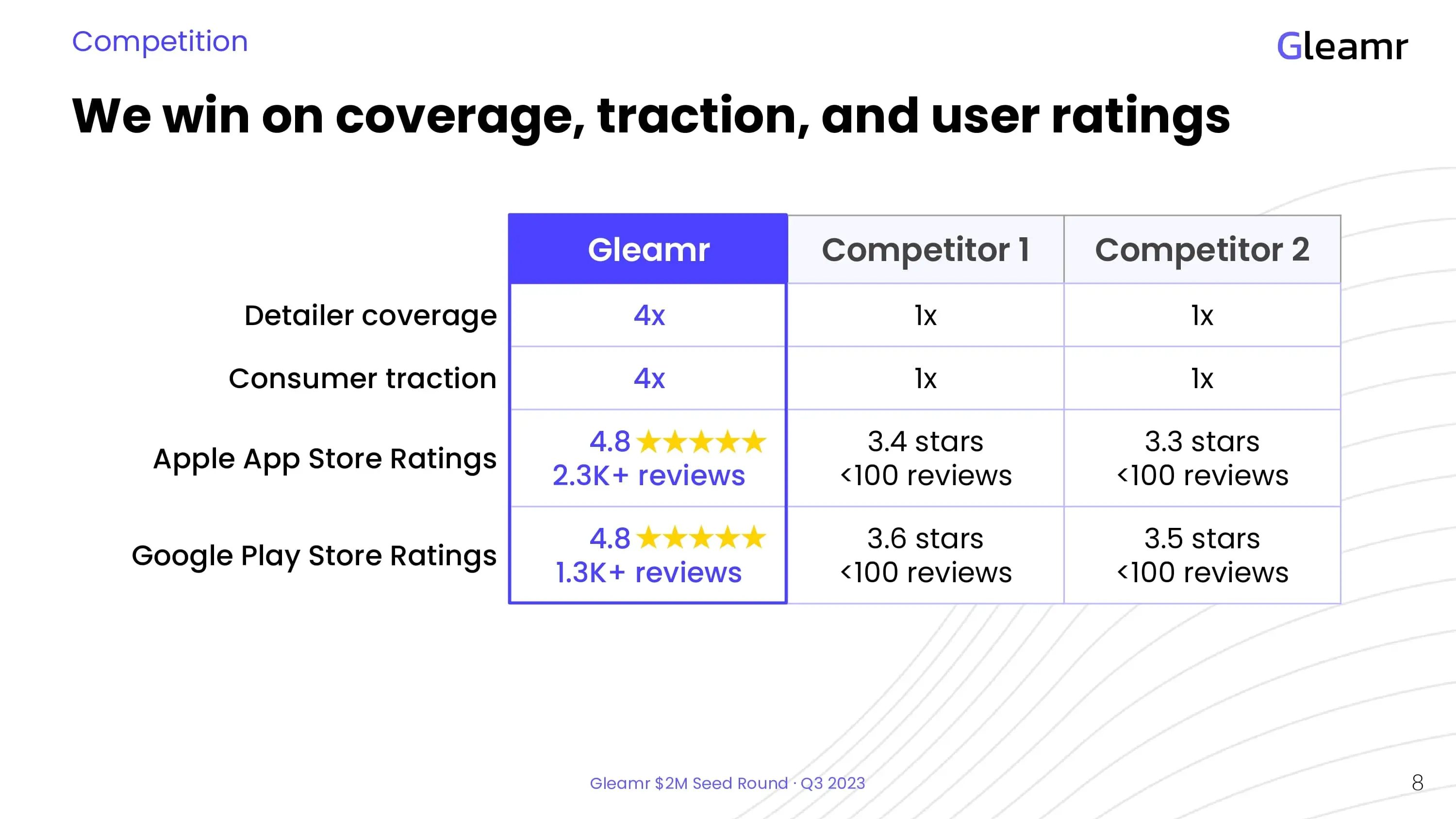

The Competition slide is critical for investors. And yet, many startups do a poor job with it and are unable to differentiate their product. Remember that investors want minimal product risk. It's easy to identify a large, growing market. It's much harder to build a differentiated product that will convince customers and users to switch solutions.

Never say you have no competitors. You'll lose credibility fast. A market with no competitors suggests that your market doesn't exist or is too small to pursue. You must identify your competitors. And you must provide at least one or two sustainable competitive advantages.

Bear in mind that you'll have both direct and indirect competitors. Be sure to identify both. Google, for example, competes directly with Facebook and other providers of online advertising. They also compete indirectly with TV, radio, print, and other providers of offline advertising.

If you are pioneering new technology, your only competition might be the old manual way of doing things. For example, before Uber, we had to call a cab company for our 5 am ride to the airport.

More typically, you'll have at least three types of competitor: A manual process; Legacy software; or other new startups like yours. You need to position yourself against each category of competitor that applies to your startup.

You have two options for the layout of your Competition slide. The first is the classic 'Gartner Magic Quadrant' 2x2 competitive landscape chart. Here you identify the two most important points of differentiation between you and your competitors and construct your graph accordingly. In the example below, Gleamr is more convenient and less expensive than other options.

A second option is the competitive matrix/grid. This is the classic 'We have it; they don't' grid. With this option, list important solution features and benefits down the left side of your table. Then list yourself and your competitors across the top. Note that "important" is what your target customers consider valuable, not you. With five features/benefits plus yourself and three major competitors, you would end up with a 5x4 grid. Your solution should be the only one that checks the box for all five features/benefits that drive your target customers' purchase decisions.

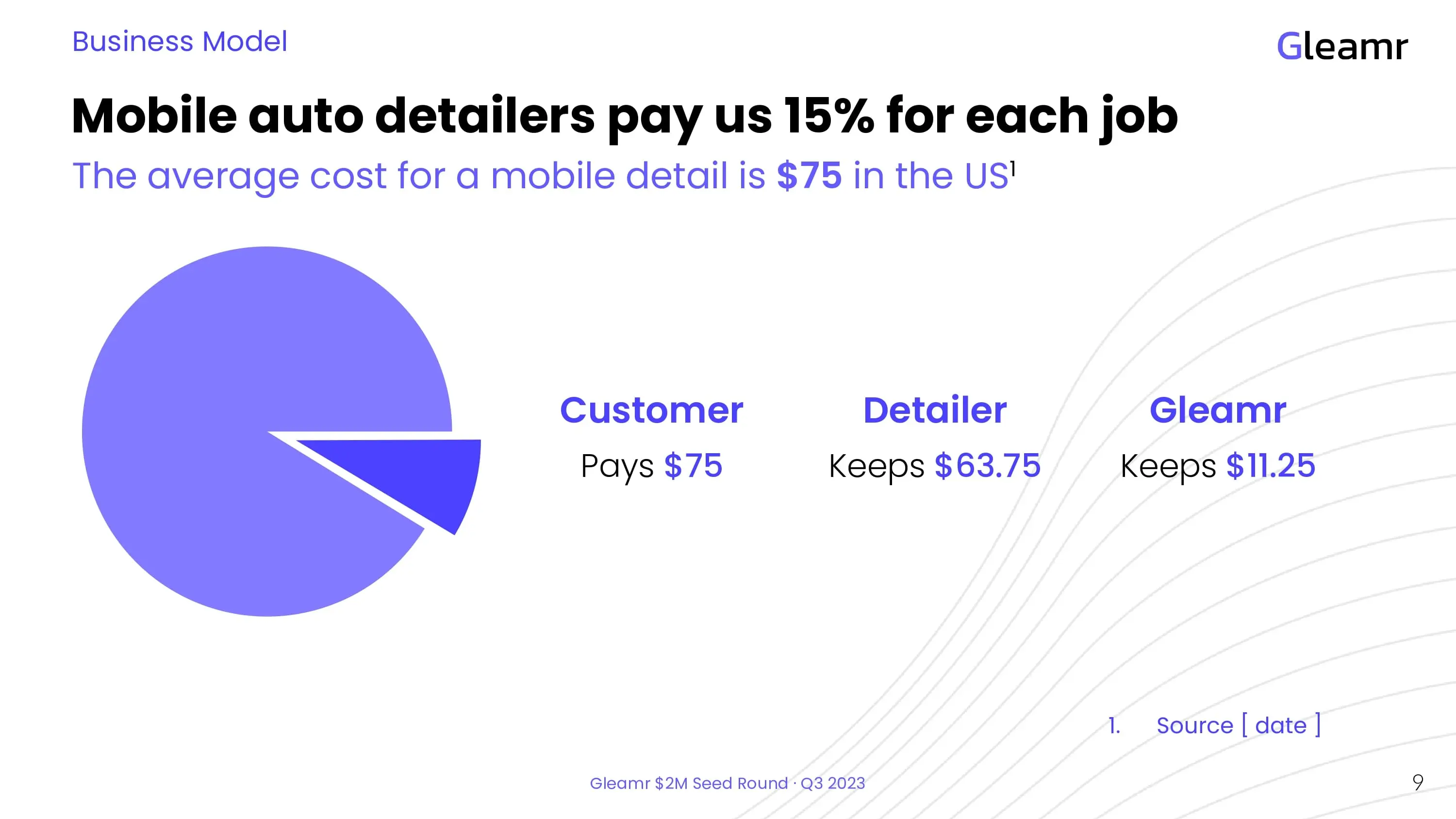

Now it's time to explain how you make money. Keep it simple. Do focus on the primary revenue model you'll use to monetize your customers. Don't provide a laundry list of potential revenue streams that may never materialize.

Investors prefer active revenue streams (products or services) to passive streams (advertising or affiliate fees). The exception to this rule is when the passive revenue is attached to a very sticky product like Google or Facebook.

Investors also prefer recurring revenue streams, like monthly or annual subscriptions. They know that keeping existing customers is much less expensive than acquiring new customers.

Provide proof that your target customers are willing to pay your price. A growing base of paying customers would be definitive proof. But survey results or a quote from a prospect is better than nothing if you have not yet launched.

Your Business Model slide sets up your Market Opportunity slide, where you show how much money you can make if you dominate your market. Your business model drives the bottom-up version of your Market Opportunity slide.

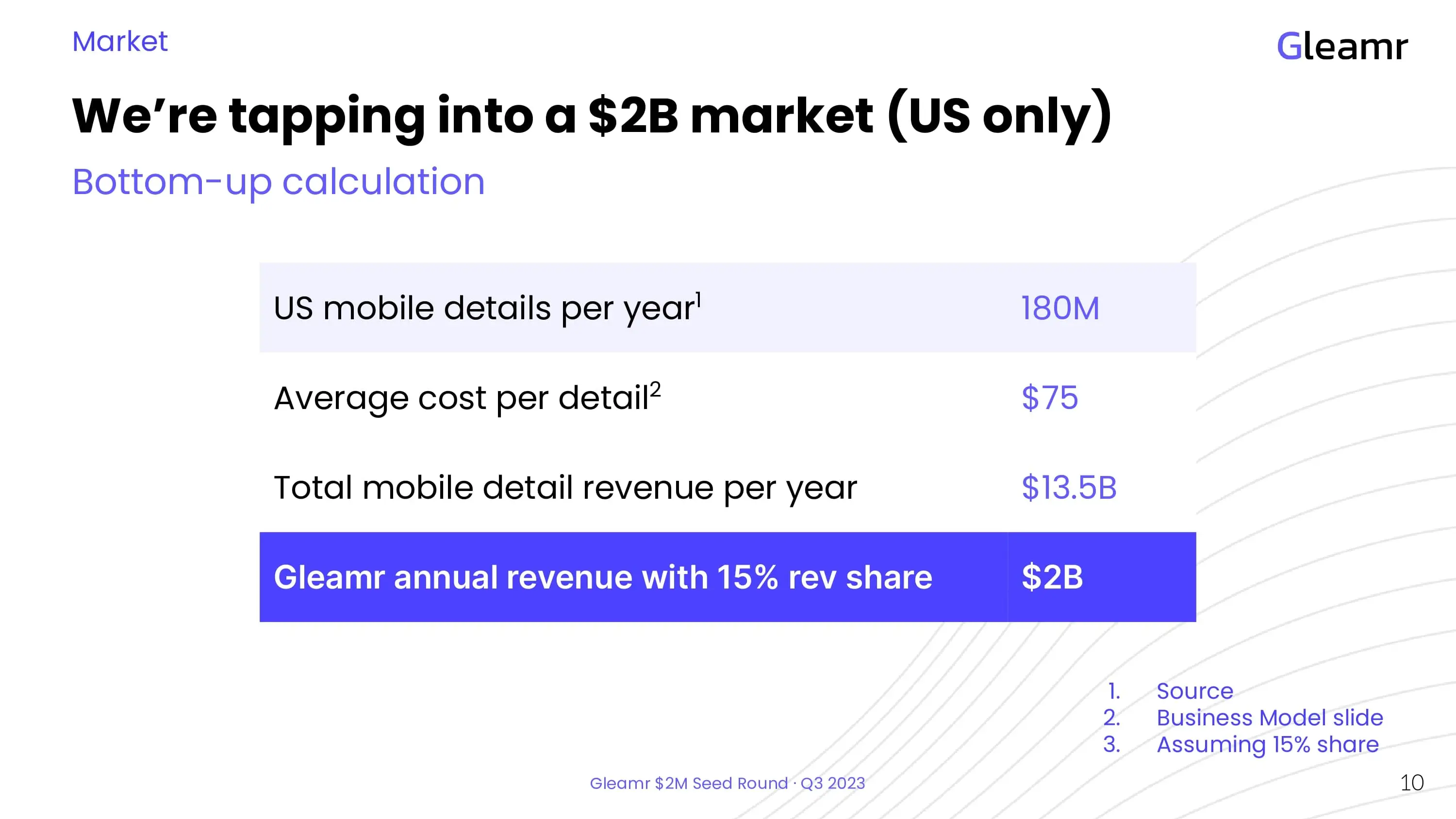

Your market is the collection of potential customers for your product or service. Some investors like to see both a top-down and bottom-up analysis. The bottom-up analysis is more credible. If you only pick one, choose bottom-up.

Reference any external forces — such as new technologies or legislation — that could accelerate your market's growth or extend its life. This helps investors answer the 'Why now?' question.

A bottom-up analysis uses simple math to size your market opportunity. For example, how many people could buy your product each year? And how much would they pay?

Annual market opportunity = Annual customer count x average sale value

Most investors will do this math themselves. They'll ask you how much your first few customers paid you and then ask you how many more similar customers exist that you can readily sell to.

This analysis lays out your two underlying assumptions for investors. First, the number of customers and transactions. Second, the average price paid per customer per transaction per year for your product. You hope that investors will agree that your assumptions are reasonable. Regardless, you gain credibility by using explicit assumptions. I recommend using big round numbers that are easier to process and remember.

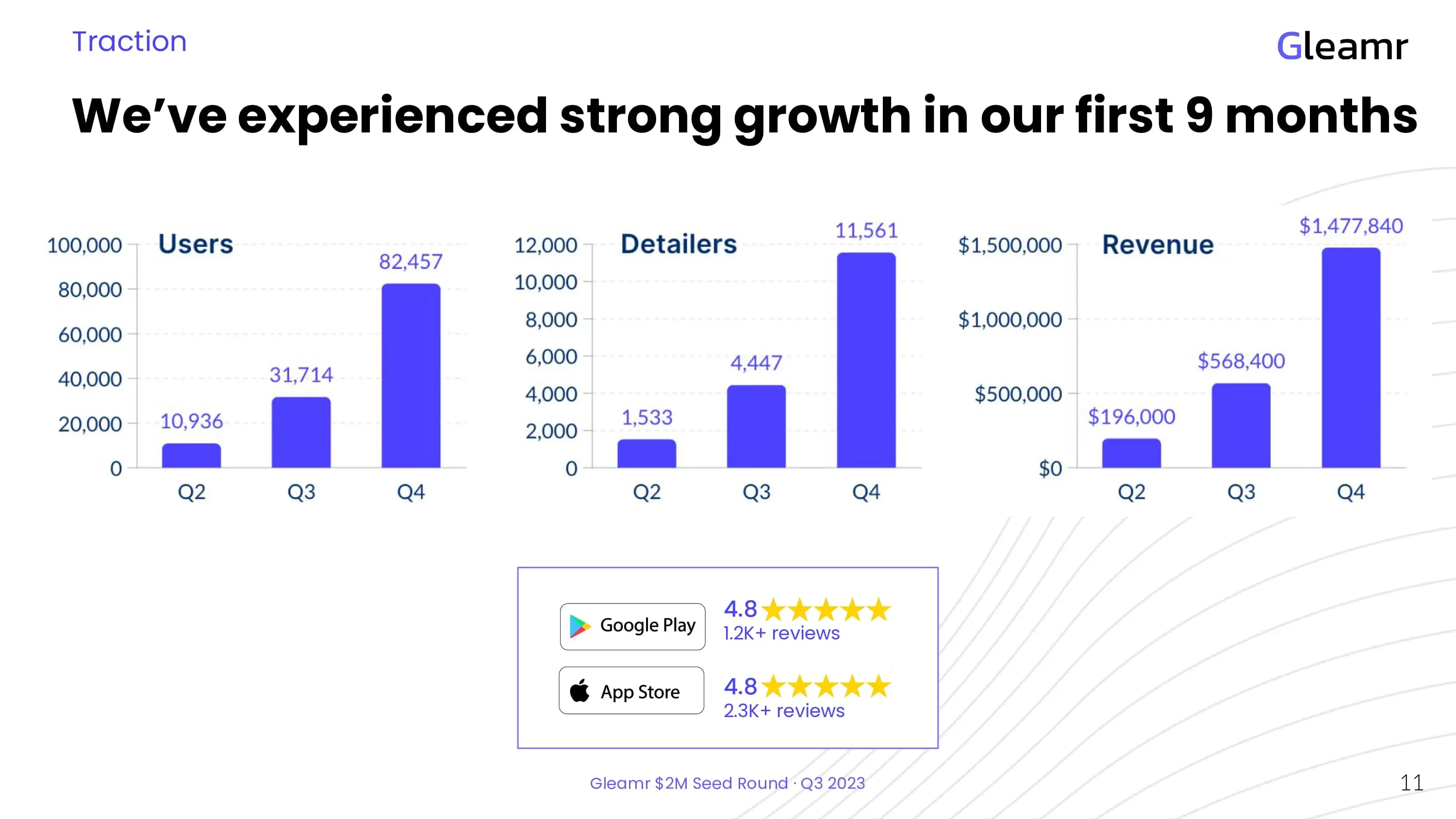

This slide can really help you. Traction speaks volumes. It addresses all four risk factors investors consider when evaluating your pitch: Market risk, Product risk, Team risk, and Execution risk.

If customers are buying, there must be a market for your product. Your product must be competitive. And you must have at least some marketing and sales expertise. Once you show traction, the only questions remaining are: One, can you replicate your initial success at scale? And two, can you keep your product competitive as you grow?

The conversation changes with traction. You switch from asking investors to fund an idea to funding growth. Funding ideas comes with a lot of market and product risk. Funding growth puts those risks behind you and your investors, and the focus becomes execution risk.

Measure and report traction using acquisition, retention, and expansion metrics. Use them to manage your business and measure success. These metrics include your average customer acquisition cost (CAC), the average lifetime value of your customer (LTV), your total number of paying customers, monthly active users (MAUs), your monthly recurring revenue (MRR), your average revenue per user (ARPU), your monthly churn rate, your net revenue retention (NRR), and so on.

When using key metrics to illustrate traction, don't stop with point-in-time snapshots. Trends and comparisons tell a bigger story. An attractive scenario for investors, for example, might be customers and revenue doubling monthly, shorter sales cycles, bigger deals, expanding up-sell revenue per customer, and declining customer acquisition costs.

If you haven't yet launched your product, then you have no traction to discuss. In that case, use this slide to identify significant milestones for product, hiring, and funding. Even if you don't have traction, you should still list your traction metrics. It tells investors you understand the mechanics of your business and the levers you'll need to pull to make it successful. When discussing revenue growth, I recommend you also call out your revenue drivers. More on this on the Financials slide.

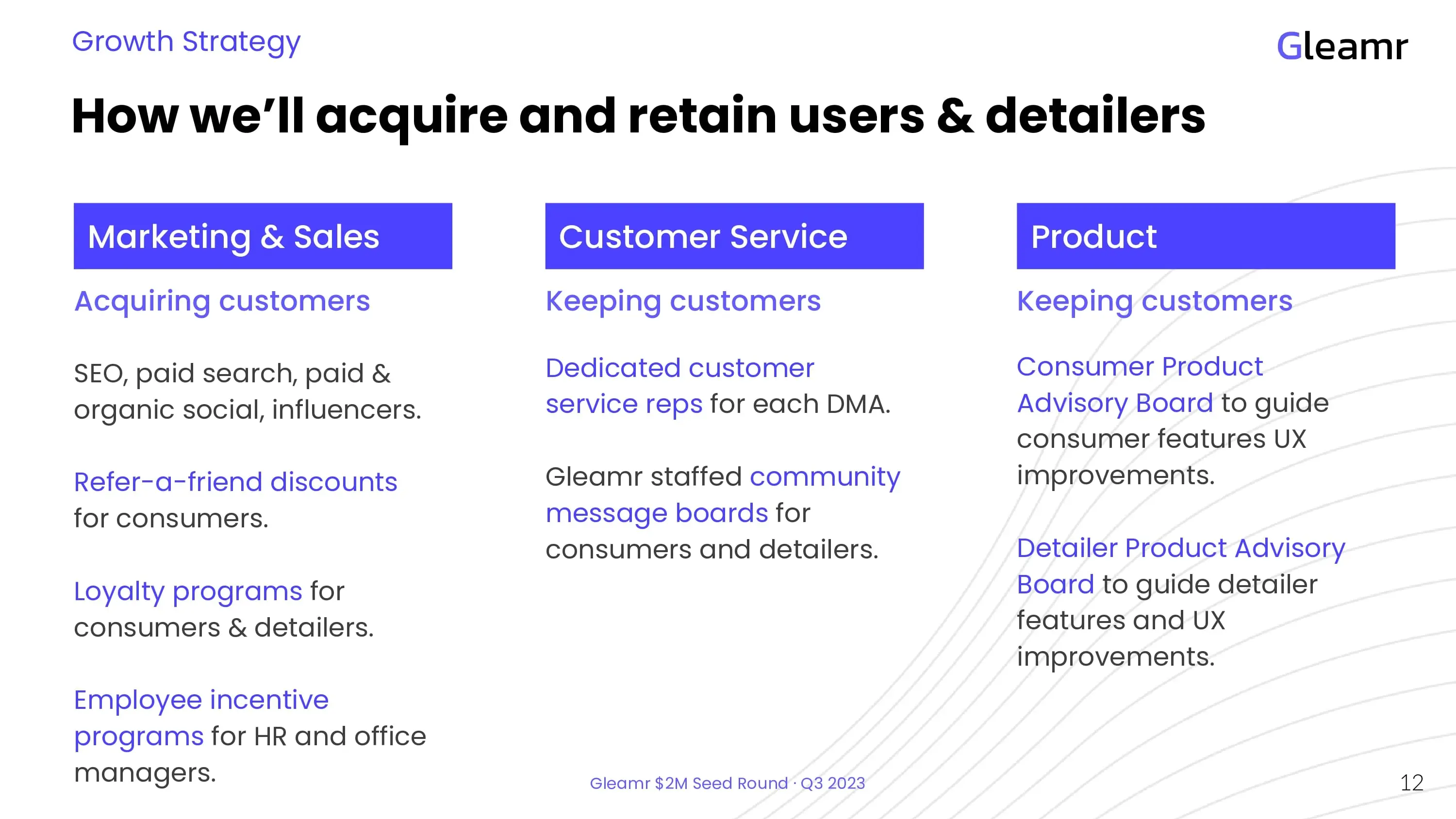

This slide addresses execution risk. Some people call it the Go-to-Market slide. Use it to convince investors that you can transform a competitive product for an attractive market into a substantial, sustainable business. Discuss your execution plan for each of these three critical startup activities:

You need to share three key metrics with investors to show you have a viable business that can scale. You need to get empirical data for these three numbers as soon as possible.

Generating an LTV that is 3-5x your CAC is a fundamental prerequisite for a profitable business.

The easiest way to calculate CAC and LTV is to do it period by period. For example, add up all your sales and marketing costs for a month or quarter. That's your CAC. Then add up your new customer revenue for the same period and calculate your LTV.

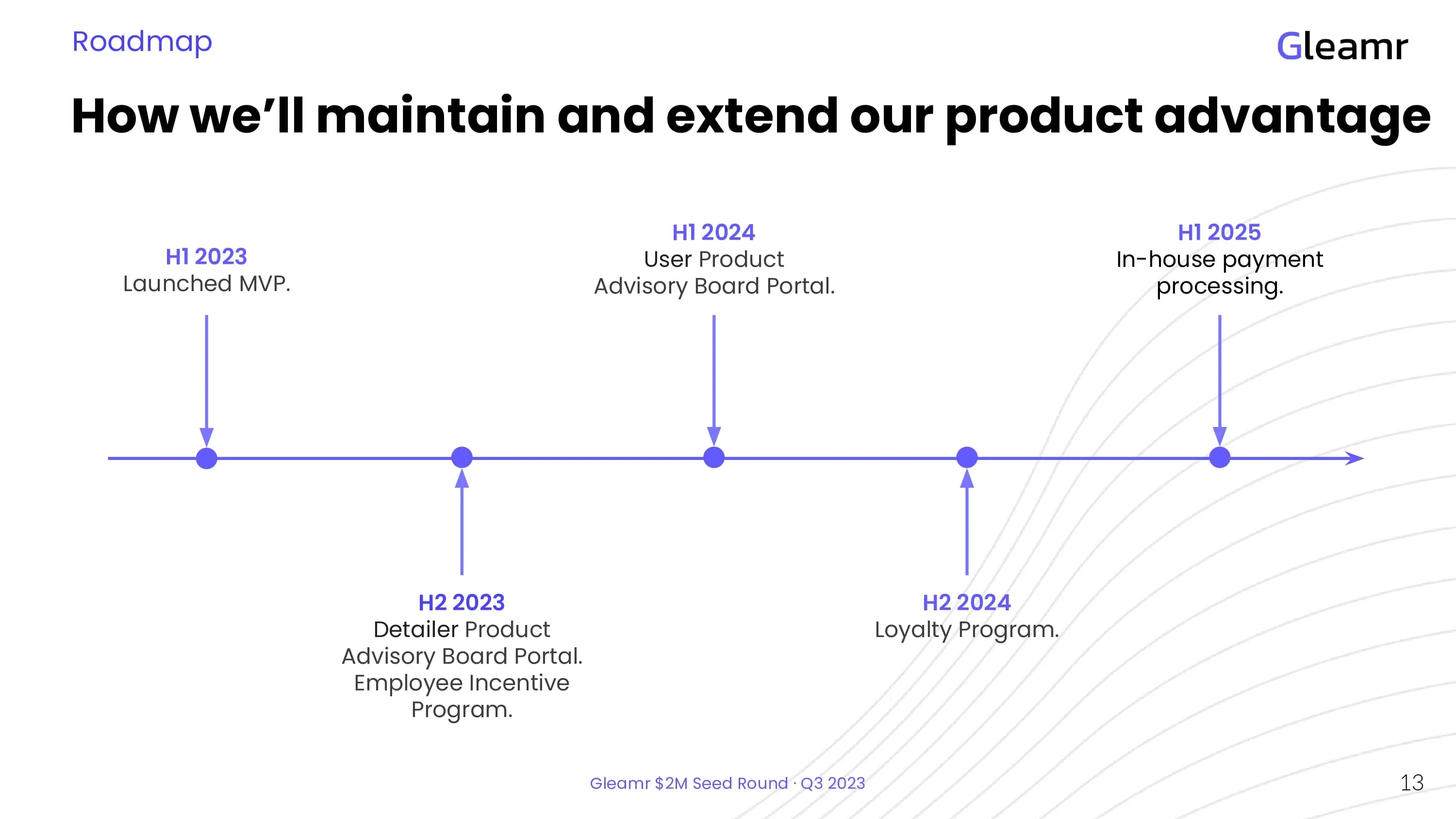

This slide expands on your plans to enhance and expand your product in order to maintain and extend your competitive advantages and grow your business in new directions. Common product milestones include major new features, new modules (e.g., HubSpot adding Sales and Customer Support modules to their Marketing platform), new integrations, and new certifications (e.g., SOC 2 or HIPAA compliance).

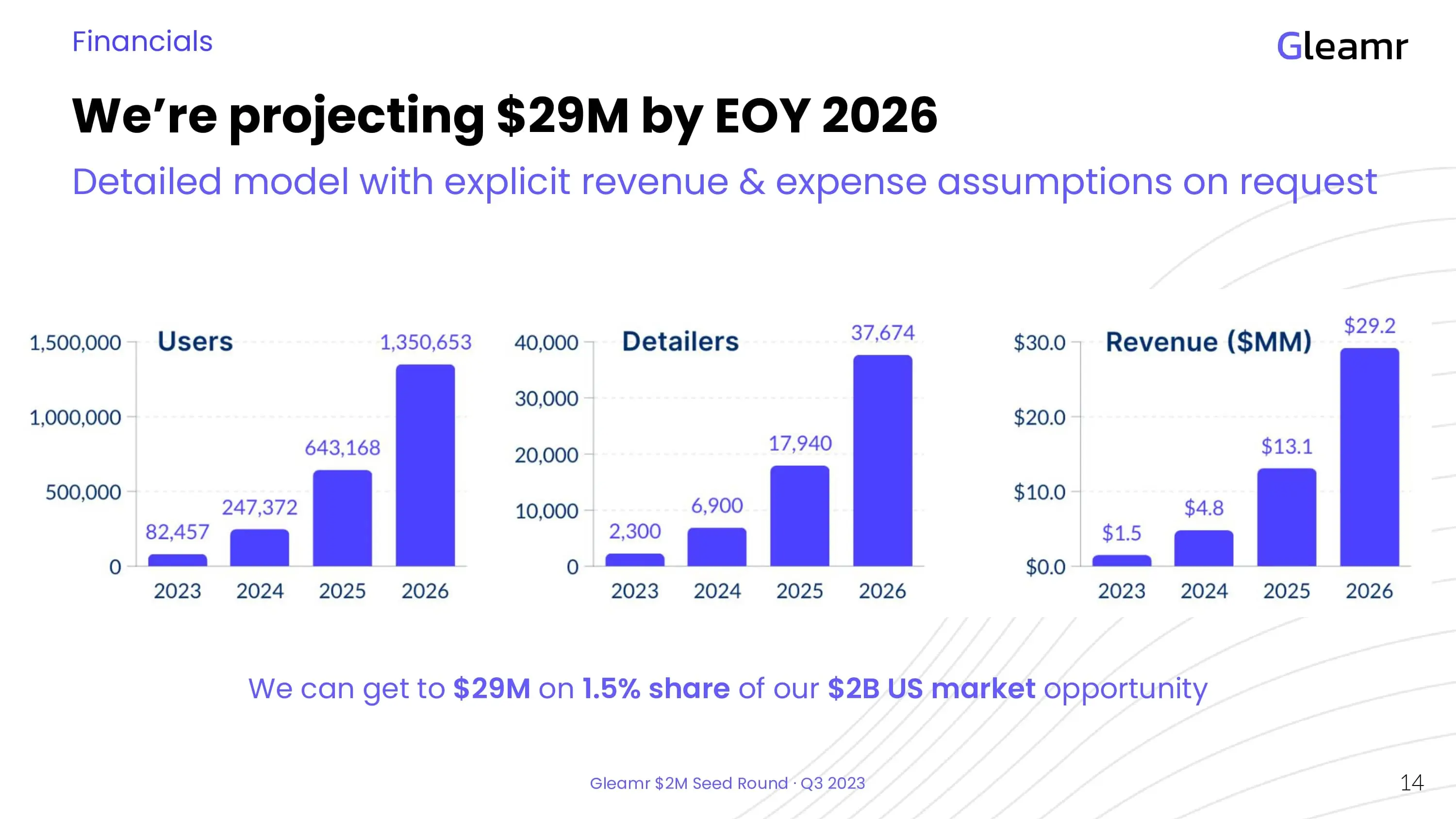

Your Financials slide presents your best-guess projection of revenue and expenses for the next three years. The numbers themselves aren't that important. Just make sure they are not so small that they are uninteresting to investors. And not so large that they are unbelievable. Remember, the T2D3 rule of thumb mentioned earlier represents an attractive revenue curve.

I recommend that you share the summary or highlights version of this slide in the deck you share online. Keep the detailed version for in-person presentations or provide on request to investors that have read your deck and want more detail on the numbers.

Get your numbers into the right ballpark and highlight your key assumptions. These assumptions include your revenue drivers plus operating expenses for marketing, sales, product development, and customer service. Investors can then decide for themselves if they think your assumptions are reasonable.

Include cumulative EBIT (Earnings Before Interest and Tax). This lets investors see how much money you'll burn before you become profitable. I also suggest you include percentages alongside your numbers. This saves investors from doing math in their heads for things like margins and various operating expenses as a percent of revenue. Most investors have a good idea, based on experience, of what percentage of revenue you should spend on each operation.

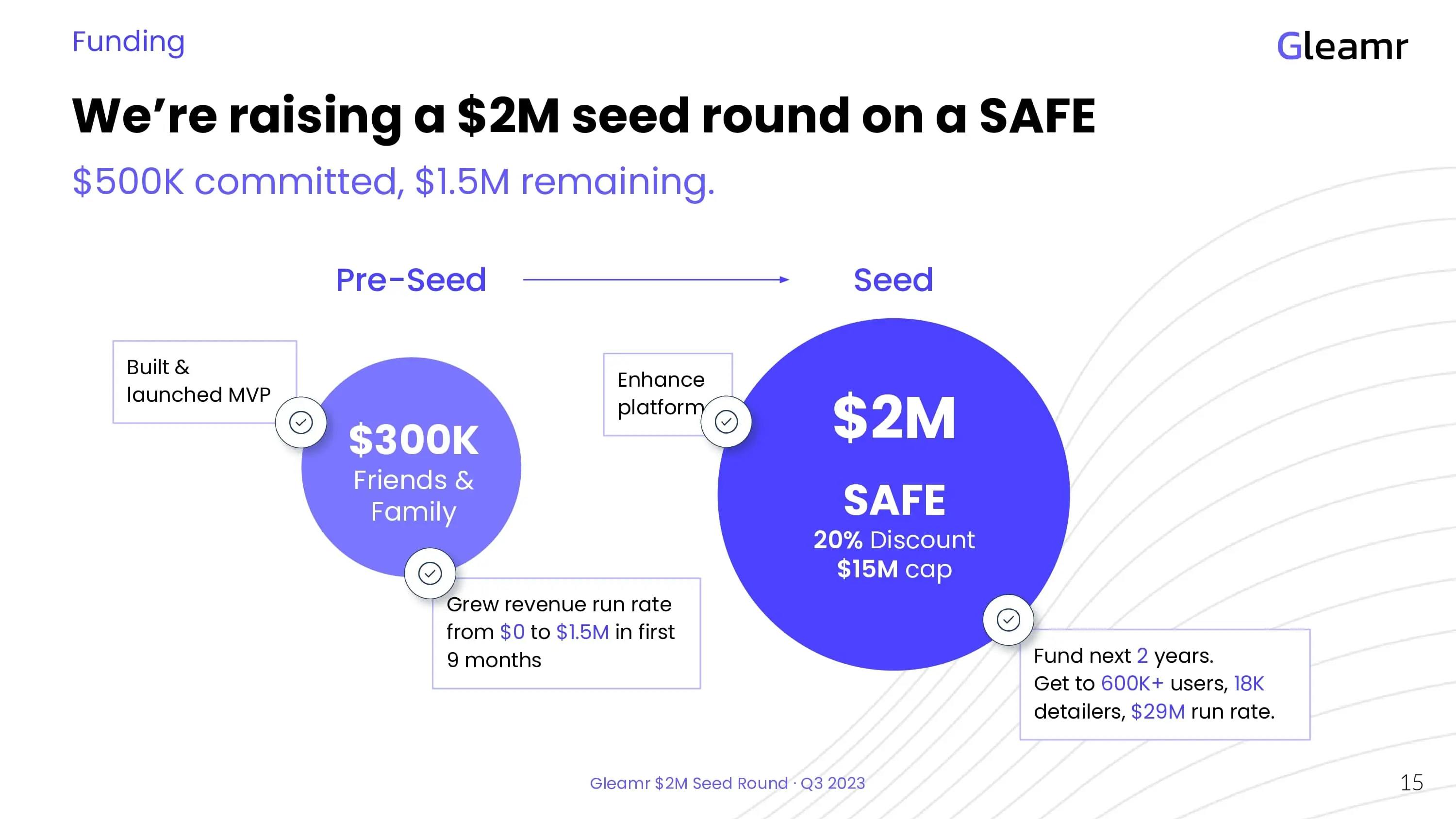

Finally, we come to the ask slide. By now, you should have identified a large, growing market, described (or launched) a competitive product, and introduced a team that can get the job done. In other words, you should have convinced your audience that you can deliver a high return on investment with low market, product, and execution risk.

Now it's time to ask for the money. Tie your ask back to the financial model on your Financials slide. In my example below, Gleamr asks for the $2M they need to execute Year 1 of their business plan. The plan identifies what traction (users, customers, and revenue) the investor should expect. And how much of their money Gleamr will spend on Sales, Marketing, Customer Support, and Product.

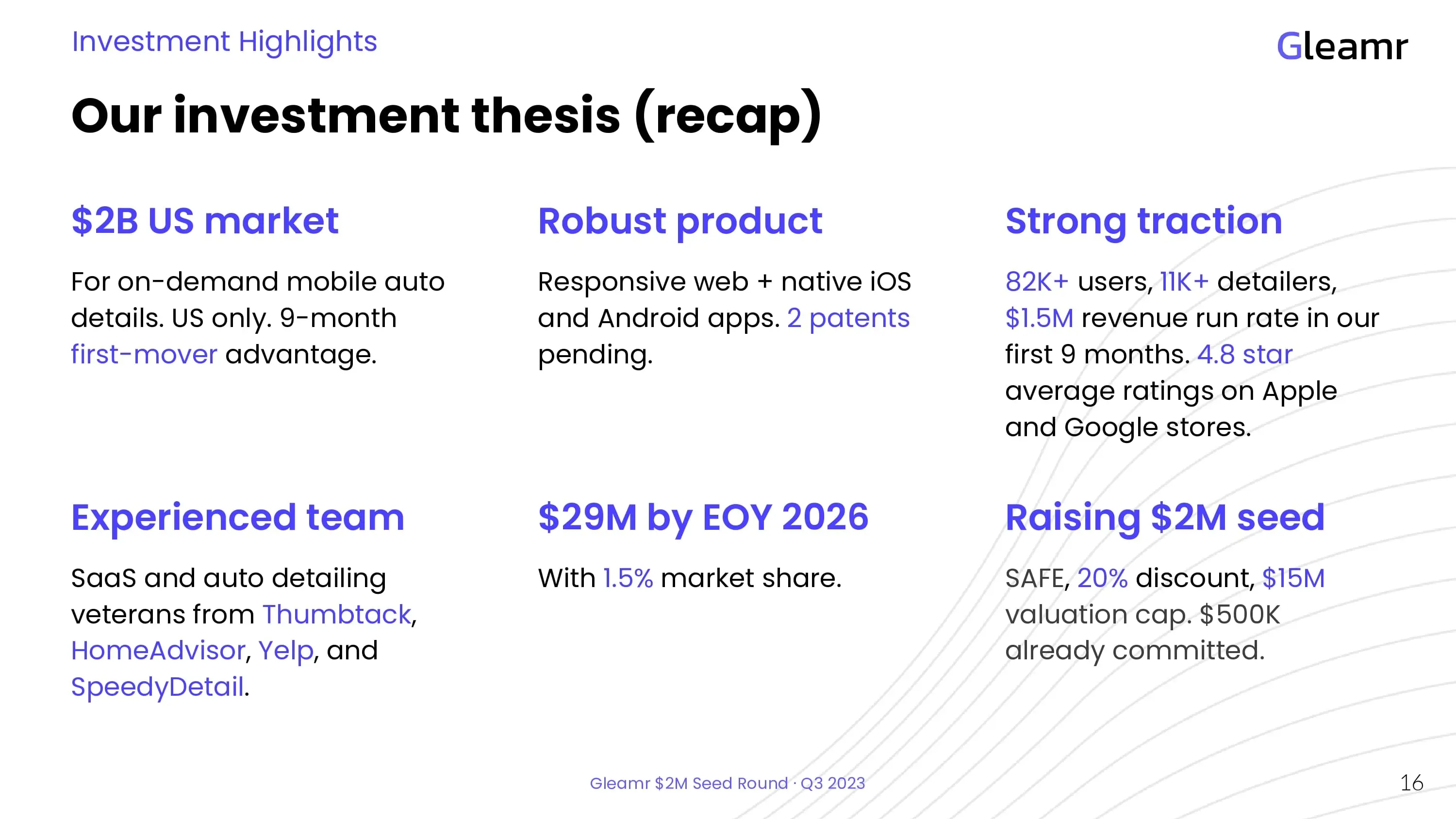

Leave a recap of your Investment Highlights slide up while you answer questions. It lets you refer back to each of your investor highlights and end on a high note.

That completes our discussion of what to include in your pitch deck. But before I finish, let's take a moment to talk about elevator pitches.

Make sure investors know who to contact with follow-up questions.

Thanks for reading. I hope you found this pitch deck template helpful. If you're interested in my help with your pitch deck, check out my pitch deck coaching services.